The dream of monetary independence burns bright across francophone Africa. From Senegal to Burkina Faso, voices rise demanding freedom from the CFA franc and its colonial-era monetary arrangements.

But here’s what everyone misses: Simply replacing one government-controlled currency with another solves nothing.

I’ve spent years watching how governments handle money, and the pattern is crystal clear: every single government, when given control over money printing, eventually does the same thing: they spend more than they earn and print their way out of trouble.

This happens because of human nature and political incentives. Politicians need money to fund their promises. When tax revenues fall short, the printing press looks like an easy solution. The inflation that follows takes time to hit, often showing up after the next election.

How Every Government Abuses Money

Take the United States, supposedly the gold standard of fiscal responsibility. The national debt now exceeds $37 trillion, and annual deficits routinely surpass $1.5 trillion. The Federal Reserve keeps printing money to buy government bonds, and ordinary Americans pay the price through higher prices at the grocery store.

If the most powerful economy on earth can't maintain fiscal discipline, what makes anyone think smaller nations will do better?

France controls the CFA franc used by 14 African nations while lecturing us about monetary policy, yet France violates European Union deficit rules repeatedly. French public debt keeps climbing while inflation eats away at citizens’ purchasing power. In other words, the “master” can’t even manage his own house.

China built its economic miracle on reckless credit expansion and government spending. Local government debt now exceeds $9 trillion, and the property sector is collapsing. Beijing’s money printing created asset bubbles that threaten the entire system.

Greece spent years overspending until it triggered a sovereign debt crisis. The government couldn’t print euros to solve their problems, so they needed painful bailouts instead. Argentina has suffered chronic inflation and repeated currency crises because the government keeps printing pesos to fund deficits. Turkey’s lira collapsed recently due to unorthodox monetary policies and deficit spending.

And what about Africa?

Where our governments control their own currencies, the results speak volumes. Zimbabwe’s hyperinflation reached an incomprehensible 89.7 sextillion percent in 2008. That’s 89,700,000,000,000,000,000,000 percent inflation (no, this is not a typo!) They printed banknotes worth 100 trillion Zimbabwean dollars that couldn’t buy a loaf of bread. People’s life savings became worthless paper overnight.

Nigeria’s naira has lost over 70% of its value in recent years despite having oil wealth, with inflation reaching over 28% in 2023. Ghana’s cedi kept falling with inflation hitting 54% in 2022 despite IMF interventions.

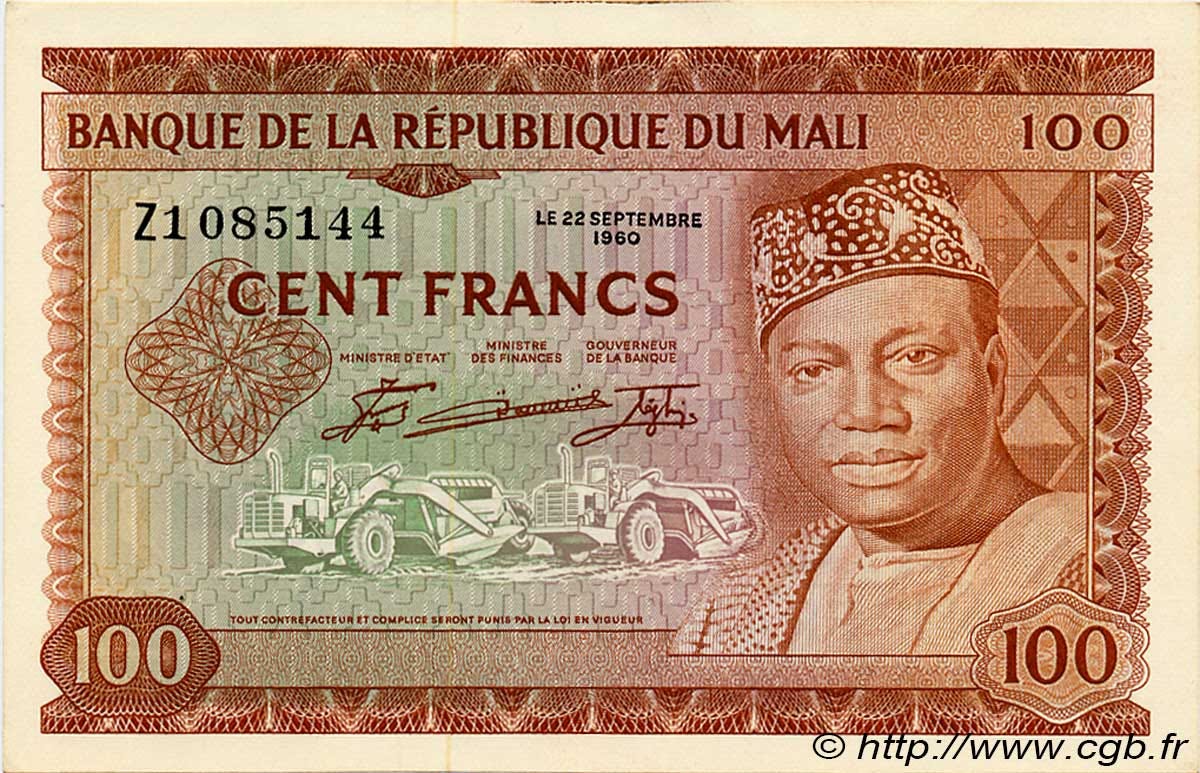

Even when African countries tried to escape colonial monetary control, the results were disastrous. Mali under Modibo Keita withdrew from the CFA franc zone in 1962 and created their own currency, the Malian franc. Within five years, reckless government spending and money printing destroyed the currency. Mali was forced to return to the CFA franc in 1967, admitting their monetary experiment had failed completely.

Meanwhile, countries using the CFA franc have maintained relatively stable prices despite the colonial baggage. That should tell us something important about the difference between monetary sovereignty and monetary discipline.

The pattern is universal. Governments cannot resist the temptation to manipulate money. They will always choose short-term political gain over long-term monetary stability.

It happens in rich countries, poor countries, democratic countries, and authoritarian countries everywhere.

Why Another Fiat Currency Won’t Save Us

I completely understand the anger about the CFA franc.

French monetary control over African nations is modern colonialism, plain and simple. We should absolutely end this arrangement.

But most people think the solution is creating another government-issued currency controlled by Senegal, ECOWAS, or some other African institution. This misses the fundamental problem. The issue stems from the printing press existing at all, regardless of who controls it.

Think about it this way: if I gave you a machine that could print money whenever you needed it, how long would you resist using it? Even with the best intentions, the temptation would eventually become irresistible. We put our governments in exactly this situation with fiat currencies.

Simply replacing the CFA franc with another government-controlled currency means changing masters while keeping the same flawed system. The new currency would face the same political pressures, the same emergency excuses, and the same debt traps that have destroyed every other fiat currency in history.

We need a completely different approach.

Incorruptible Money

Africa has a unique opportunity right now. Instead of repeating the mistakes of every other continent, we can leapfrog directly to truly sovereign money that no government can manipulate: Bitcoin.

Bitcoin’s supply is mathematically fixed at 21 million coins.

No politician can promise to print more. No central bank can manipulate its value for political purposes. No government can debase your savings to fund their spending. Mathematics and code enforce this, making it completely immune to human corruption.

Think about what this means.

For the first time in human history, we have money that governments cannot touch. No more watching your savings evaporate because politicians needed to fund their latest project. No more currency devaluations that make imports unaffordable. No more inflation that hits the poor hardest while the connected get richer.

During the transition, stablecoins can serve as practical bridges. They offer price stability for daily transactions while the Bitcoin ecosystem develops; there are essentially stepping stones to true monetary sovereignty.

Bitcoin solves the real problems that plague every fiat system. Governments cannot debase citizens’ savings. There’s no wealth confiscation through money printing. International trade and remittances become seamless. Financial services become available to everyone without needing government permission.

And by the way, Bitcoin isn’t some anonymous tool for shady actors — it’s actually one of the most transparent financial systems in the world, with every transaction recorded on a public ledger. Governments cannot debase citizens’ savings

This revolution is already happening. El Salvador made Bitcoin legal tender and is building a Bitcoin-powered economy. Other countries are watching closely. The question becomes whether Africa will lead or follow.

We can follow the same path as every other region in history, trading one flawed fiat system for another and watching our savings disappear through government incompetence and political manipulation.

Or we can choose something unprecedented: money that no government can touch, no politician can manipulate, and no central banker can print.

The evidence is overwhelming. From Washington to Beijing, from Paris to Abuja, governments cannot be trusted with monetary control. They will always choose political expediency over monetary stability.

Monetary sovereignty without monetary discipline means changing which politician gets to steal from your savings account.

True sovereignty means they can’t steal at all.

What can you tell me about Gadaffi and his attempts at transforming to a gold standard? From what I understand, this was the reason why he was overthrown by the U.s. You probably know a thing or two about the history of Libya. Thanking you in advance.

This is such an important and often misunderstood debate—thank you, Magatte, for cutting through the noise with clarity.

What gets missed in many Western commentaries is how monetary infrastructure—like the CFA franc—isn’t just economic policy. It’s a form of emotional governance. A psychological residue of empire dressed up as financial “stability.” The very idea that France, a former coloniser, still guarantees and governs African currencies while locking capital into its own coffers is neocolonialism in code.

George the Poet captures this tension beautifully in Track Record. He doesn’t just talk about wealth extraction—he names the cultural theft, the epistemic silencing, the emotional gaslighting of being told your dependency is your fault, when it was designed that way.

“They robbed the gold and sold the dream. Now they say we’re poor because we can’t manage the nightmare.”

The CFA debate isn’t just about economics—it’s about narrative sovereignty. About who gets to tell the story of African competence, ambition, and direction.

We need more discussions like this that centre economic dignity as inseparable from political freedom.

#EconomicJustice #NarrativePower #CFAFranc #Decolonisation #GeorgeThePoet #TrackRecord #MaintenanceGospels #LotBO #SubstackCommunity